6. Rake leaves. To make quicker work of collecting leaves from a large lawn, rake the fallen foliage onto a large plastic tarp. Then bag it or add it to your compost pile.

To-Dos: Your October Home Checklist

As Home Equity Rises, So Does Your Wealth

By KCM Crew via Keeping Current Matters Current

Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In addition to long-term stability, buying a home is one of the best ways to increase your net worth. This boost to your wealth comes in the form of equity.

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

The best thing about equity is that it often grows without you even realizing it, especially in a sellers’ market like we’re in now. In today’s real estate market, the combination of low housing supply and high buyer demand is driving home values up. This is giving homeowners a significant equity boost.

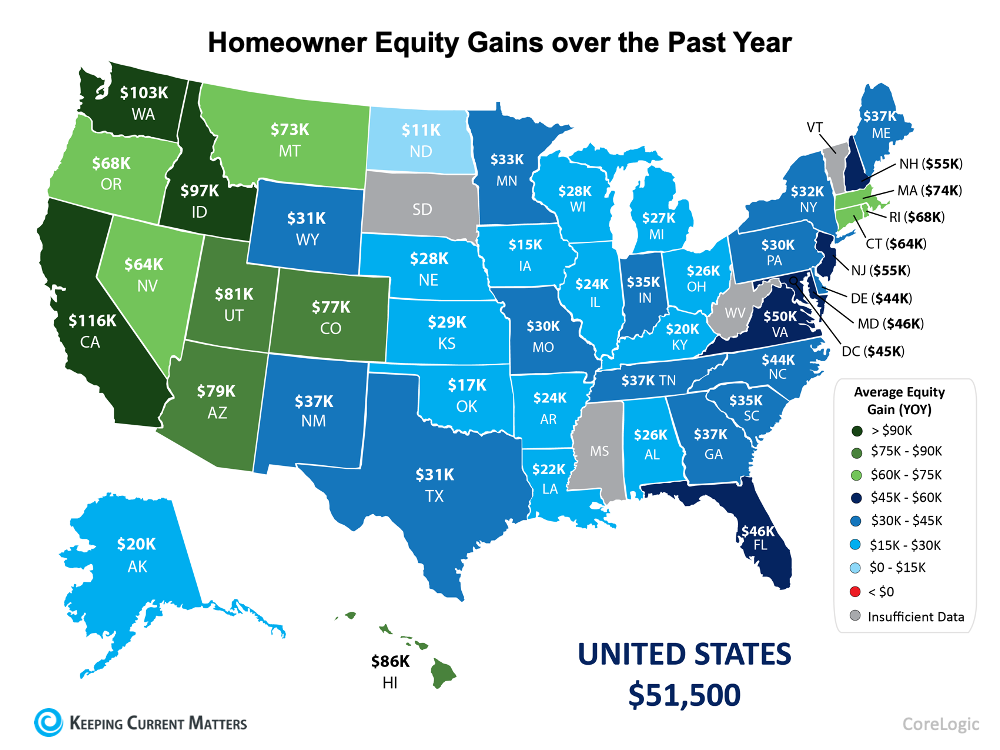

According to the latest data from CoreLogic, the amount of equity homeowners have has continued to grow as home values appreciate. Here are some key takeaways from the Homeowner Equity Insights Report:

- The average homeowner gained $51,500 in equity over the past year

- There was a 29.3% increase in national homeowner equity year over year

To give you an idea of what that looks like in your area, the map below shows the average equity gains by state.

What does all of that mean for you?

If you’re already a homeowner, you likely have more equity in your house than you realize. The numbers in the map above reflect year-over-year growth. If you’ve been in your home for longer than a year, you’ll likely have even more equity than that. That equity can take you places. You can use the equity you’ve gained to fuel your next move, achieve other life goals, and more.

On the other hand, if you haven’t purchased a home yet, understanding equity can help you realize why homeownership is a worthwhile goal. Homeowners across the nation gained an average of over $50,000 in equity this year. Don’t miss out on this chance to grow your net worth.

Bottom Line

If you want to learn more, talk with a real estate professional. A trusted advisor can help you understand where home prices are today, how they contribute to a homeowner’s net worth, and the impact equity can have when you own a home.

A Guide to Remodeling Your Bathroom

by Sandy Dodge

There are a variety of reasons that a homeowner may decide to remodel their bathroom; they could be looking to increase the value of their home for a future sale, they may have discovered repairs that need to be made, or perhaps they’re simply looking to maximize their enjoyment of the space. Whatever your motivation may be, consider the following information before the hammer hits the tile to make sure your bathroom remodel turns out as successful as you’d hoped.

A Guide to Remodeling Your Bathroom

Which bathroom remodel projects have the highest ROI?

Before you decide which projects to tackle, it’s worth your while to identify which bathroom remodeling projects have the highest ROI. This can be especially helpful if you’re thinking about selling your home in the near future. According to recent nationwide data released by Remodeling Magazine, bathroom remodels can have as high as a sixty percent return on cost, while larger projects like bathroom additions return roughly fifty percent of their costs. The point is you likely won’t recoup every dollar you spend on your bathroom remodel, so choose your projects wisely. If you’re preparing to sell your home, talk to your agent about which bathroom projects are seeing the highest return in your local area.

How can I save on my bathroom remodel?

There are various ways to keep your costs down when remodeling your bathroom, but it depends on the scope of your project. If, while preparing to sell your home, you identify a handful of outstanding repairs that need to be fixed before you list, it may be difficult to pull off a low-budget bathroom remodel while still fetching a competitive sales price. Neglecting these issues can be a costly mistake, and in some cases can even jeopardize a sale.

One way to save money on your bathroom remodel is to do it yourself. Identify the pros and cons of either doing a project DIY or hiring a professional. Though you may save money on labor, if you get in over your head on a project the costs can add up quickly, and you may end up having to hire a contractor to remedy the situation. If you decide to hire a contractor, thoroughly research multiple companies, ask for referrals from family and friends, and get multiple quotes before deciding which is best for the job.

Simple Bathroom Upgrades

As the scope of a bathroom remodel changes, so do its costs. According to Remodeling Magazine’s 2021 Cost vs. Value Report, a midrange bathroom remodel cost an average of roughly $24,000 nationwide, while an upscale bathroom remodel was just over $75,000. But fear not, there are ways to give your bathroom a makeover without having to break the bank. Here are a few ideas for budget-friendly bathroom upgrades.

- Refinish Your Tub: Remove all hardware from your tub and sand the entire surface smooth, evening out any chips or cracks and filling them with epoxy. Once the epoxy has dried, sand those areas one more time. Apply multiple layers of primer and topcoat as advised and buff the surface to finish off the job.

- Add Décor: A well-decorated bathroom can revitalize the space. Add a fresh coat of paint to the walls, install a new faucet and shower head, and match your towel rods and shower curtains for a quick bathroom refresh.

- Finishing Touches: The right bathroom lighting can make all the difference. Experiment with softer light bulbs or dimmers to create a sense of calm and relaxation. Add candles, scented oils, and new towels to make your bathroom feel like your own personal spa.

Buying and Selling a Home at the Same Time

by Sandy Dodge

Successfully selling a home and buying a home are significant accomplishments on their own, but when their timelines cross it can be difficult to manage both. If you’re thinking about doing both simultaneously, it’s equally important to understand the steps you can take to make the process go smoothly as it is to have a backup plan in case it doesn’t. Above all, the balancing act required to pull off both deals highlights the importance of working closely with a trusted and experienced real estate agent.

Do I buy or sell first?

One can imagine a perfect world in which the two transactions go through one right after the other. However, this is not usually the case. So, should you list your current home first or start by putting in offers on a new one? There are pros and cons to both.

Selling your current home first allows you to make offers on a new home with cash in your pocket, increases your buying power, and avoids having to juggle two mortgages simultaneously. On the other hand, it creates a gap of residence, often leaving homeowners wondering where they’ll stay until they move into their new home or whether they may need to rent before they can buy again. Sellers may also negotiate a rent-back agreement with the buyers, allowing them to rent the house from the new owners before they move in.

Buying before selling solves the need for any temporary housing and makes the overall moving process much easier. Having a residence established ahead of time means you’ll only have to move once, which can save you some serious stress during this time of transition. Oppositely, buying a new home before you sell your current one will put an added strain on your finances. Having two concurrent mortgages equates to taking on more debt, which could result in less-than-favorable loan terms for purchasing your new home. Without the lump sum generated by a home sale in your pocket, coming up with enough money for a down payment may be a challenge and obtaining private mortgage insurance (PMI) may be in the cards. Finally, buying before selling comes with an obvious assumption—that your current house will sell.

Ultimately, the order of operations depends on your situation. Perhaps you’re moving due to a change of employment, and you need to direct all your energy toward buying a new home by a certain date before you can even think about selling your current one. No matter which route you take, it’s important to communicate your timeline to your listing agent or your buyer’s agent so they can strategize accordingly.

Buying and Selling a Home at the Same Time

Local Market Conditions

Buying and selling at the same time will come with a certain duality: at each step in the process, you’ll have to balance your responsibilities as both a buyer and a seller. For example, when assessing your local market conditions, you’ll be looking at not one, but two housing markets.

- Seller’s Market: Selling in a seller’s market means that that you’ll need to be prepared to move once you list, since you could be looking at a short selling timeline. However, relying too heavily on the assumption that your house will sell quickly could make things dicey down the road. If you’re buying in a seller’s market, finding a new home may take longer than expected. You could potentially be waiting weeks or months for an offer to get accepted.

- Buyer’s Market: Selling in a buyer’s market typically means that homes stay on the market longer. If you proceed with a new home purchase just after you’ve listed your current house, know that it may take a while to sell. If you’re buying in a buyer’s market you can afford to be picky, knowing that time is on your side. With fewer people buying homes, sellers will be more flexible, giving you leverage to negotiate your contingencies.

Having a Backup Plan

If only you could wave a magic wand and make both transactions go through as planned. That’s why it’s important to have a backup plan in place to right the ship should things go sideways at any point in the buying or selling process. Talk to your agent about which options may be right for you. Here are a few:

- Sales Contingency: Buying your new home with a sales contingency allows you to opt out of the purchase contract if your home doesn’t sell by a specified date. Purchasing contingent on the sale is rare in highly competitive markets.

- Bridge Loan: If your current home hasn’t sold yet and you’re not able to afford the down payment on a new home, a bridge loan may be a fitting solution. Bridge loans can be used to cover the down payment on a new house and are repaid once your existing home has sold.

- Rent-Back Agreement: A rent-back agreement is a clause in the sales contract that allows the seller to rent their old home from the buyer for an agreed-upon period of time before the buyer moves in. This can be especially helpful in situations when the seller is having trouble finding a new home.

Reasons You Should Consider Selling This Fall

Article by Keeping Current Matters

If you’re trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers’ market we’re in today won’t last forever. If you’re thinking of making a move, here are four reasons to put your house up for sale sooner rather than later.

1. Your House Will Likely Sell Quickly

According to the Realtors Confidence Index released by the National Association of Realtors (NAR), homes continue to sell quickly – on average, they’re selling in just 17 days. As a seller, that’s great news for you.

Average days on market is a strong indicator of buyer demand. And if homes are selling quickly, buyers have to be more decisive and act fast to submit their offer before other buyers swoop in.

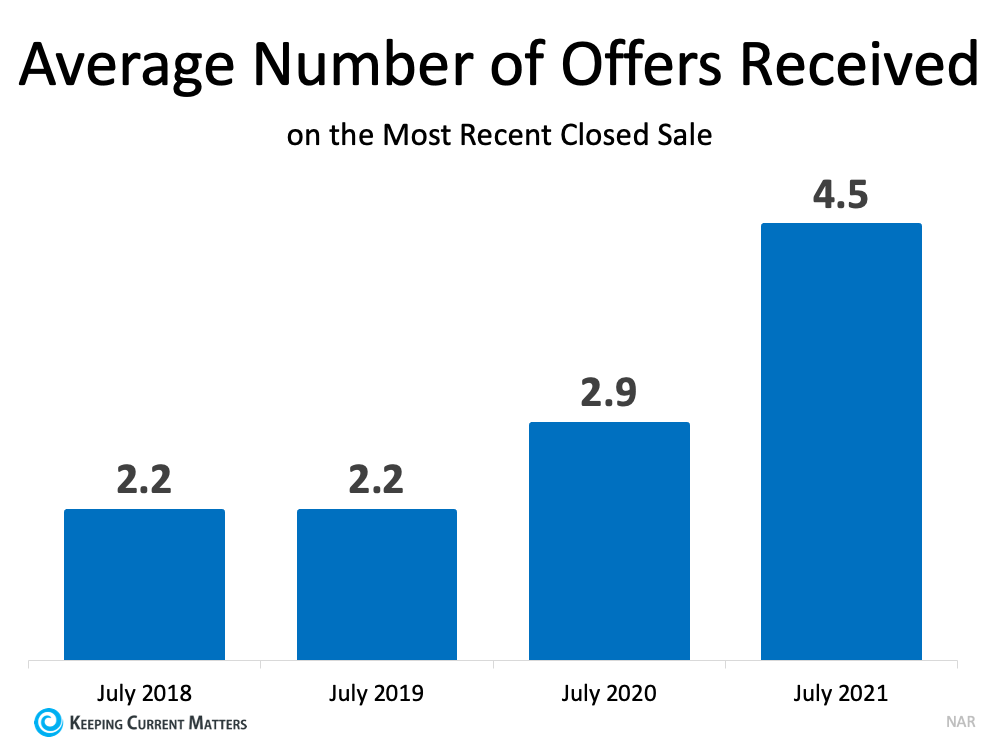

2. Buyers Are Willing To Compete for Your House

In addition to selling quickly, homes are receiving multiple offers. That same survey shows sellers are seeing an average of 4.5 offers, and they’re competitive ones. The graph below shows how the average number of offers right now compares to previous years: Buyers today know bidding wars are a likely outcome, and they’re coming prepared with their best offer in hand. Receiving several offers on your house means you can select the one that makes the most sense for your situation and financial well-being.

Buyers today know bidding wars are a likely outcome, and they’re coming prepared with their best offer in hand. Receiving several offers on your house means you can select the one that makes the most sense for your situation and financial well-being.

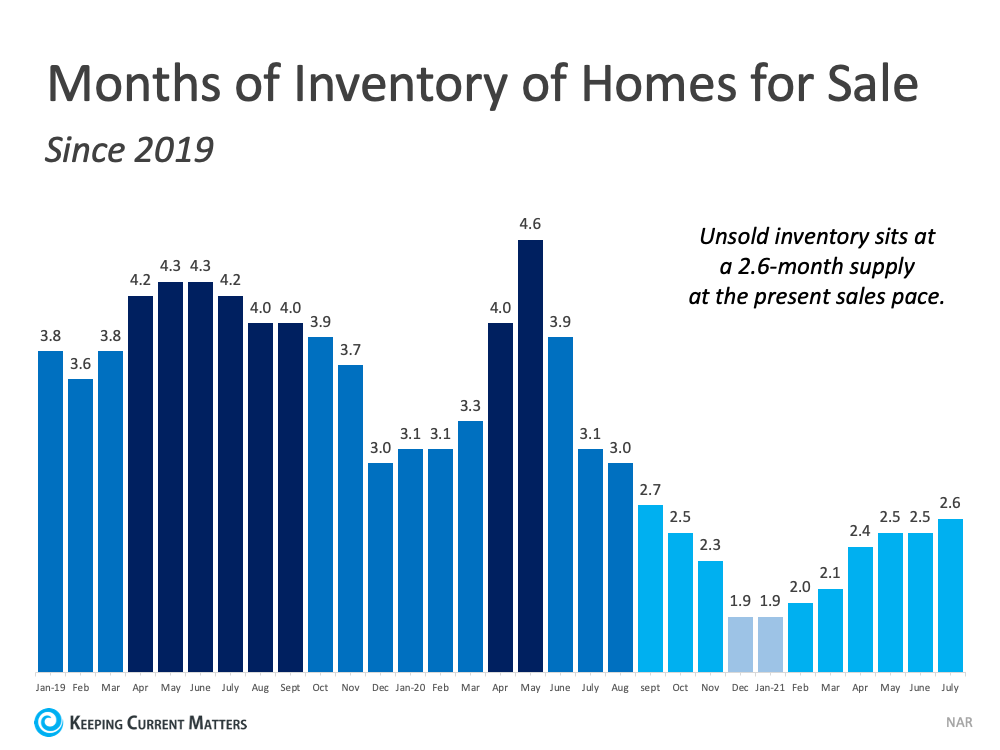

3. When Supply Is Low, Your House Is in the Spotlight

One of the most significant challenges for motivated buyers is the current inventory of homes for sale. Though it’s improving, it remains at near-record lows. The chart below shows how today’s low inventory stacks up against recent years. The lighter the blue is in the chart, the lower the housing supply. If you’re looking to take advantage of buyer demand and get the most attention for your house, selling now before more listings come to the market might be your best option.

If you’re looking to take advantage of buyer demand and get the most attention for your house, selling now before more listings come to the market might be your best option.

4. If You’re Thinking of Moving Up, Now May Be the Time

If your current home no longer meets your needs, it may be the perfect time to make a move. Today, homeowners are gaining a significant amount of wealth through growing equity. You can leverage that equity, plus current low mortgage rates, to power your move now. But these near-historic low rates won’t last forever.

Experts forecast interest rates will rise. In their forecast, Freddie Mac says:

“While we forecast rates to increase gradually later in the year, we don’t expect to see a rapid increase. At the end of the year, we forecast 30-year rates will be around 3.4%, rising to 3.8% by the fourth quarter of 2022.”

When rates rise, even modestly, it’ll impact your monthly payment and by extension your purchasing power.

Bottom Line

Don’t delay. The combination of housing supply challenges, low mortgage rates, and extremely motivated buyers gives sellers a unique opportunity this season. If you’re thinking about making a move, reach out to your real estate advisor to talk about why it makes sense to list your house now.

Construction Jobs

When you see people working to build a new home or new commercial building, you may wonder how much money they earn.

Here is some interesting research from the Bureau of Labor Statistics which ranks the highest-paying construction jobs based on median annual income.

Who knew that elevator and escalator installers would be at the top?

- Elevator and Escalator Installer = $88,540

- Boilermaker = $65,360

- Building Inspector = $62,860

- Electrician = $56,900

- Plumber = $56,330

- Ironworker = $53,210

- Sheetmetal Worker = $51,370

- Carpenter = $49,520

- Equipment Operator = $49,100

Windermere Living: Summer Parties Made Simple

This article originally appeared in the Summer 2021 issue of Windermere Living.

By Amanda Zurita

Summer, especially this summer, is meant for barbecues, outdoor movie nights, garden gatherings, and rooftop cocktail affairs. Keep the focus on reconnecting with friends and family by opting for unfussy, minimalist decor and clean color palettes. It’s about time we have something to celebrate, isn’t it?

Backyard Barbecue

Upgrade the summertime tradition of the backyard barbecue with stylish and simple tools.

Image Credit: Jayme Burrows / Stocksy

The most time-honored summertime gathering takes place in your own backyard, and a lineup of modern tabletop grills and tools means you can feed a fête without much fret. For example, BergHOFF’s sleek tabletop grill has a compact design that can easily transport to a balcony or the beach—simply add charcoal, and you’re ready to take orders. Or switch it up with one of this year’s most popular cooking contraptions, a portable pizza oven, like the one made by Ooni. With models powered by gas or by wood fire, these ovens can cook a 12-inch pizza in as little as 60 seconds and will work for meats and vegetables, too. Focus on main courses, and ask your guests to bring sides or desserts to share. Complete the ambience by piping a playlist through portable outdoor speakers like the Move by Sonos, which are equipped with voice control and Bluetooth tech, so you can play DJ with ease.

Elevate Your Grill Game Without Going Too Crazy

-

Burgers on the menu? Stuff them with gourmet cheeses, like bleu or mozzarella, before throwing them on.

-

Sitting down together? Time your steaks right by searing them first and finishing them just before serving.

-

Make it a pizza night—with or without a pizza oven. Load pies with your favorite fixings, roll them out on a pizza stone, and cook them over the open flame.

-

Don’t skimp on fruits and veggies. Grilled vegetables are summer’s side dish; peaches and pineapple make for a sweet and juicy dessert (make it á la mode!).

Garden Party

Elevate your outdoor space with basic romantic elements.

Image Credit: Trinnette Reed / Stocksy

A garden party is a glorious way to gather with friends for an elegant afternoon. Start by creating a special space in the yard by laying down some outdoor rugs or erecting a temporary canopy to provide shade. To illuminate the celebration, surround the table with candlelit lanterns, or string outdoor lights between overhead branches. Then, it’s all about the tablescape. Select durable (and unbreakable) dishware like sustainable bamboo plates and bowls from Fable New York, which come in a range of colors like soft blush, buttery yellow, and eggshell blue. The same goes for glasses, which can be as durable as they are chic in fluted acrylic designs from West Elm. To distribute your chosen refreshments, fill a cheery pineapple-shaped beverage dispenser from Nordstrom with punch or lemonade, or stock bottles of bubbly in a sleek Permasteel rolling patio cooler. Once you’ve covered the dining and decor, add extras that keep your guests comfortable, like classic paddle fans, supplied by party stores and wedding suppliers like The Knot. Keep mosquitoes at bay with a discreet Patio Shield repeller by Thermacell, which creates a 15-foot zone of protection around your gathering.

Add a touch of natural beauty by creating simple flower arrangements based on what’s in your yard—or the local farmers market. Seasonal blooms like tulips, peonies, and ranunculus come in many shades and have a textural, wild appearance. To step outside the expected, add branches from cherry or olive trees or fresh fruits from trees on your property. Take your time adding and subtracting elements until you achieve a look you love. A flower frog or stretch of lattice can help hold everything in place. For a minimalist spray, choose a monochromatic color palette, or keep it light with just a few blooms.

Sunset Soirée

Watch the sun set from your rooftop, porch, or balcony at an elegant yet restrained affair.

Image Credit: Jovo Jovanovic / Stocksy

To set a classic (and classy) mood, make a portable record player the center of attention, and invite guests to bring a favorite album. Many options, like the turntables from Crosley, have Bluetooth capabilities, so you can link speakers and switch to digital music with ease. To keep the evening chill away, set up a portable fire pit (Solo offers wood-burning, smokeless options in a number of sizes). Citronella candles, like Pottery Barn’s artful candle, help maintain the romantic ambience while keeping the buzz kills away.

Cheers to You

A polished party deserves an equally upscale signature drink, but you don’t want to spend all night playing bartender. A Champagne punch you can batch in advance is easy to make but elegant enough to fit the vibe. This recipe for a berry satsuma sangria will fit the bill and please a crowd, especially when served in shatter-resistant stemware from Williams Sonoma. Prepare about an hour before your party to preserve the bubbles.

Ingredients

- 6 satsuma oranges

- 1/2 pint strawberries, sliced

- 1 pint raspberries

- 1 bottle of chilled dry Champagne or sparkling wine

- 6 oz Grand Marnier liqueur

- 4 oz club soda

- 2 oz cherry brandy

- Fresh mint for garnish

Recipe

Place the segments of two oranges and all of the strawberries and raspberries into a large punch bowl or drink pitcher. Juice the remaining oranges for about . to ⅔ cup of orange juice, and add to the bowl along with the remaining liquid ingredients. Stir together and taste, adding simple syrup if it isn’t at your desired sweetness. Serve over a large ice cube and garnish with mint.

Movie Night

Everything you need to get cozy under the stars.

Image Credit: Shutterstock

Pump Up Your Popcorn

Toss plain popcorn with a variety of seasonings: try butter, salt, and truffle oil; crispy bacon, a few tablespoons bacon drippings, butter, and chopped chives; butter, sriracha, and lime—or bake popcorn on a tray with a few cups of your favorite cheeses for a crunchy-melty treat.

It’s lights, camera, action with a backyard movie night to rival any drive-in. If you’ve spent the last year watching everything Netflix has to offer from the comfort of your couch, this change of scenery is (literally) a breath of fresh air. Opening your own outdoor theater is easy with movie screens, like Pottery Barn’s streamlined option, that set up in no time and come with a portable storage bag. Upgrade from blankets or lawn chairs to specially made outdoor bean bags from Jaxx, line the aisles with IKEA’s romantic solar lanterns, and you’re ready for showtime under the stars.

Project: Projector

When choosing a projector, consider brightness levels in your yard. If you have any light pollution, you’ll likely need a projector that puts out 800 lumens for an 80-inch screen size. A short throw projector, placed three to eight feet from the screen, is ideal. Epson’s EF-100 Mini Laser Projector is a good bet, and it’s both powerful and light, weighing just under six pounds. As for audio, most projectors that do have built-in speakers won’t offer the cinematic sound quality you’re looking for, so a set of well-placed Bluetooth speakers will round out the full experience. A pair of Anker Soundcore Motion Boom speakers placed at the back corners of your viewing area can create rich surround sound. And be sure to let the neighbors know about movie night so they aren’t surprised—better yet, why not extend an invite?

Read the full issue here: Windermere Living – Summer 2021

The Difference Between a Comparative Market Analysis and an Appraisal

Comparative Market Analysis (CMA)

A CMA is conducted by an agent using their knowledge of the local market in conjunction with information available to them on the multiple listing service (MLS), which contains data on sold homes and market trends. A CMA helps to price the home more accurately, keeping the property competitive in the current market. For those who are thinking of selling their home For Sale By Owner (FSBO), it’s worth noting that you will not be able to conduct a CMA on your own, since, among other things, access to the MLS is exclusive to real estate agents.

Your agent’s analysis accounts for the various factors that influence home prices to arrive at an accurate estimate of your home’s value. A CMA compares your home to others in your area that have either recently sold, are currently on the market, or had previously listed but have since expired, typically using data from the past three-to-six months. Comparable homes, or “comps,” are homes whose characteristics are similar to your own, such as the housing type, condition, and the square footage and property size. A thorough CMA will provide information on what homes in your area are selling for, how long they were on the market, and the difference between their listing and sold price, and will list a low, median, and high selling price for your home.

Appraisal

The main difference between an appraisal and a CMA is the personnel involved. Whereas a CMA is conducted by a real estate agent, an appraisal is carried out by a licensed appraiser on behalf of the bank. Once a buyer applies for a loan to purchase your home, the bank will order an appraisal of the property. Though appraisers use methods of comparison similar to an agent’s CMA, unlike a real estate agent, bank appraisers have no vested interest in the sale of the home. The goal of an appraiser’s visit is to determine your home’s fair market value to ensure that the bank isn’t lending more money to the buyer than needed.

For more resources on the selling process and to use our free home value calculator, visit the selling page on our website here:

Simple Bathroom Upgrades

The thought of upgrading a bathroom often brings to mind large-scale renovations, demolition, and hefty price tags. Even projects like replacing a backsplash or repairing tile can be more involved than you might think. However, it’s possible to give your bathroom a makeover without breaking the bank (or your back). Whether you’re looking to just freshen it up or make it feel like your own personal spa, these simple projects can help take your bathroom to the next level.

Upgrade your Décor

If you want to make a big splash without spending big money, consider upgrading your bathroom with new décor. A fresh coat of paint on the walls or a bold, patterned wallpaper can completely change the character of the space, while accent pieces like a new shower curtain and towel racks can reinforce your color choices. Installing shelving is a simple, functional tactic that gives dimension to your walls. Whether it’s in the shower, above your toilet, or beside your vanity, a shelf can save surface space while helping to tie the room together.

Upgrade your Tub

Upgrading your tub doesn’t have to mean buying a replacement. Simply refinishing your tub will have it looking brand new and helps you save money. Over time, tubs accumulate cracks, dings, and discoloration due to mold, but refinishing can cure these imperfections right away. Start by removing all hardware from the tub. Sand the whole surface, fill in any cracks or holes with putty or epoxy, then sand them smooth. Apply multiple layers of primer and topcoat, give it a buff, and enjoy your brand-new bathtub.

If refinishing your tub is too much to handle, consider simply touching it up. Fill in any cracks and apply a fresh line of caulking around the surface. After this is done, shop around for new tub hardware to polish off your cost-effective bathtub makeover.

Upgrade Your Vanity

With just a few tweaks, you can turn your vanity area from a mirror with counter space to an impactful centerpiece. Instead of going all out with a new cabinet install, simply replacing your cabinet hardware and drawer pulls can make a big difference. Think of ways your new hardware can reinforce the style of your bathroom. Match them with your shower rod, faucet, and showerhead to make your bathroom more eye-catching.

Your vanity also offers a great opportunity to add some color to your bathroom. Giving it a fresh coat of paint will help to liven up the space at a low cost. For wooden vanities, a re-stain is a great way to give them new life. Start by removing the doors and drawers. Apply wood stripping to all surfaces, then let them sit for the recommended time. Now you can begin to scrape away the old finish. Sand down all surfaces and apply the primer before staining the wood. Once your stain settles in, apply a second coat and your vanity will be good as new.

Finishing Touches

Well-organized surfaces and compartments will help to create serenity in your bathroom. Whether it’s in the shower, the medicine cabinet, or below the vanity, look for multipurpose organizers that help cut down on bathroom clutter and save space. Add in natural elements like bamboo and river rocks to make your bathroom feel like a soothing sanctuary.

For more ideas on affordable home makeovers, check out our tips for upgrading your bedroom, home office, and kitchen.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link